-

On Financial Literacy/Well Being

A Closer Look at the Financial Capability of Hispanic Adults in the United States examines data from the FINRA Foundation’s Natio…

A Closer Look at the Financial Capability of Hispanic Adults in the United States examines data from the FINRA Foundation’s Natio… -

Games and Simulations

Con 'Em If You Can Game and Educator's Guide is a Financial Entertainment online video game that helps students recognize the red…

Con 'Em If You Can Game and Educator's Guide is a Financial Entertainment online video game that helps students recognize the red… -

Literature Review/Systematic Review/Meta Analyses

Financial Education Matters: Testing the Effectiveness of Financial Education Across 76 Randomized Experiments is a 2022 meta-an…

Financial Education Matters: Testing the Effectiveness of Financial Education Across 76 Randomized Experiments is a 2022 meta-an… -

Survey Results

Gen Z and Investing: Social Media, Crypto, FOMO, and Family is a brief based on data from a 2022 online survey of 2,872 Gen Zs (…

Gen Z and Investing: Social Media, Crypto, FOMO, and Family is a brief based on data from a 2022 online survey of 2,872 Gen Zs (… -

Lessons/Lesson Plans and ActivitiesMoney Math for Teens: Introduction to Earning Interest includes lesson plans and assessments that explore the math behind persona…

-

Survey Results

National Financial Capability Study (NFCS) provides insights into the financial capability of U.S. adults, including financial kn…

National Financial Capability Study (NFCS) provides insights into the financial capability of U.S. adults, including financial kn… -

Lessons/Lesson Plans and Activities

Smart Investing Course 1: Setting Investment Goals is an online micro-course designed to teach new investors how to develop and s…

Smart Investing Course 1: Setting Investment Goals is an online micro-course designed to teach new investors how to develop and s… -

Lessons/Lesson Plans and Activities

Smart Investing Course 2: Defining Terms is an online micro-course about investing terms and types of financial professionals. Ea…

Smart Investing Course 2: Defining Terms is an online micro-course about investing terms and types of financial professionals. Ea… -

Lessons/Lesson Plans and Activities

Smart Investing Course 3: Risk and Return is an online micro-course designed to teach students about investment risk and return, …

Smart Investing Course 3: Risk and Return is an online micro-course designed to teach students about investment risk and return, … -

Lessons/Lesson Plans and Activities

Smart Investing Course 4: Rate of Return is an online micro-course that explains investment returns and how to evaluate and compa…

Smart Investing Course 4: Rate of Return is an online micro-course that explains investment returns and how to evaluate and compa… -

Lessons/Lesson Plans and Activities

Smart Investing Course 5: Diversification is online micro-course designed to teach the importance of diversification and how to d…

Smart Investing Course 5: Diversification is online micro-course designed to teach the importance of diversification and how to d… -

Lessons/Lesson Plans and Activities

Smart Investing Course 6: Fees and Commissions is an online micro-course that explains why fees and expenses matter and how to ma…

Smart Investing Course 6: Fees and Commissions is an online micro-course that explains why fees and expenses matter and how to ma… -

Lessons/Lesson Plans and Activities

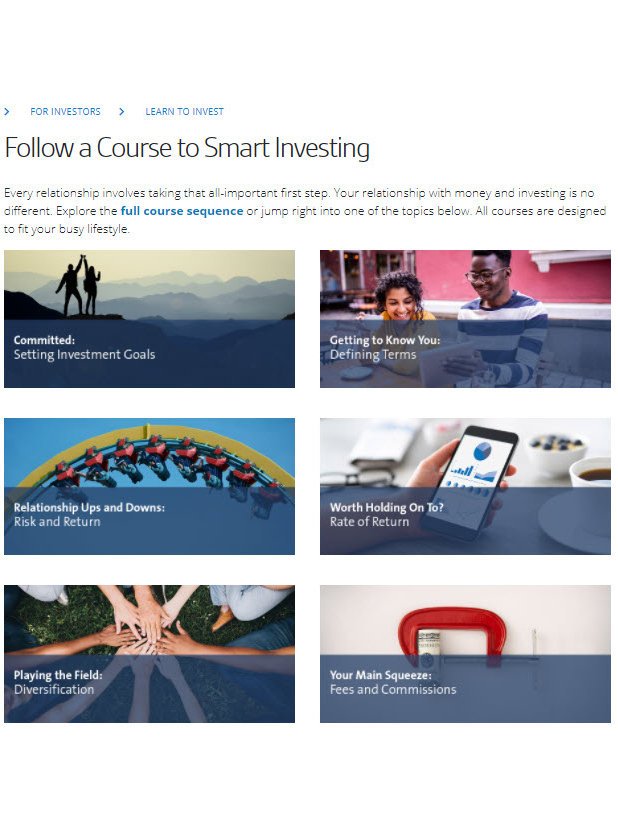

Smart Investing Micro-Courses are designed to build essential investment knowledge and skills in under 10 minutes each. Topics in…

Smart Investing Micro-Courses are designed to build essential investment knowledge and skills in under 10 minutes each. Topics in… -

Survey Results

They Just Add Up: Combined Math and Financial Knowledge Tied to Better Financial Outcomes uses data from 1,680 adults collected i…

They Just Add Up: Combined Math and Financial Knowledge Tied to Better Financial Outcomes uses data from 1,680 adults collected i… -

Articles/Brochures/Booklets

Thinking Money for ALL Kids is a book list of diverse and inclusive financial literacy books and programming ideas for young peop…

Thinking Money for ALL Kids is a book list of diverse and inclusive financial literacy books and programming ideas for young peop… -

Games and Simulations

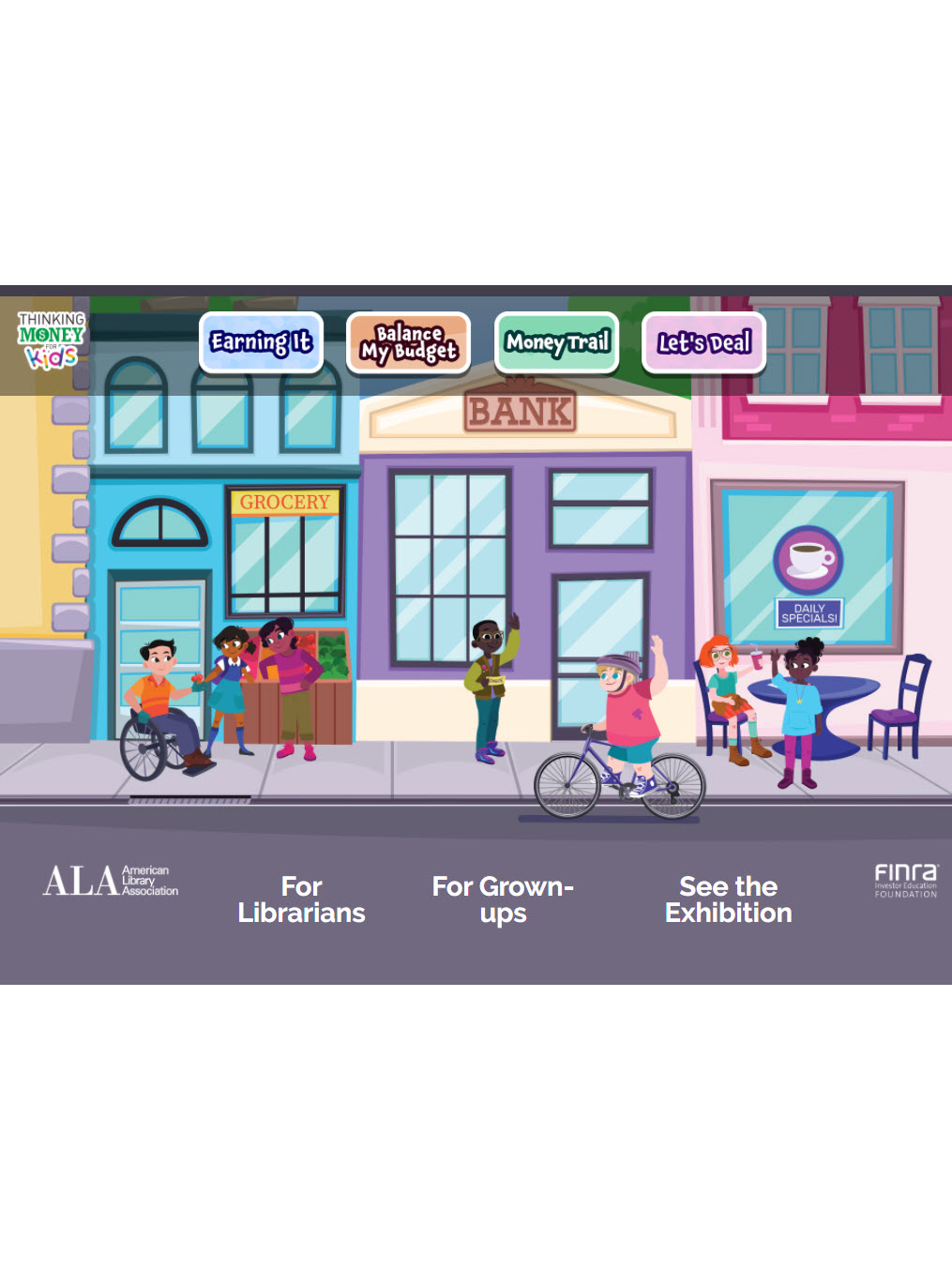

Thinking Money for Kids is a series of interactives to help young people get started on the path to financial literacy. The inter…

Thinking Money for Kids is a series of interactives to help young people get started on the path to financial literacy. The inter… -

Videos/Audio

Thinking Money: The Psychology Behind Our Best and Worst Financial Decisions is a documentary that uses a mix of insights from b…

Thinking Money: The Psychology Behind Our Best and Worst Financial Decisions is a documentary that uses a mix of insights from b…