Search results:

199 resources

Resources meet our listing criteria and align with National Standards.

Resources meet our listing criteria.

Add Filters

Clear filters

Sort list by:

-

The National Theatre for Children - Financial Content offers community outreach programs for banks, credit unions and government …

The National Theatre for Children - Financial Content offers community outreach programs for banks, credit unions and government … -

$14.49 | Edelman Financial EnginesThe Squirrel Manifesto is a modern-day fable designed to teach kids the four fundamental themes of money that will help children …

$14.49 | Edelman Financial EnginesThe Squirrel Manifesto is a modern-day fable designed to teach kids the four fundamental themes of money that will help children … -

FREE | The CentsablesDash for Cash App is designed to allow children to pick their superhero and complete money quests. It encourages players to calc…

-

My Money is an educational workbook designed to teach children about money, coin equivalents, jobs, goods, services and barter.

-

$27.99 | The Awesome StuffThe Golden Quest is the first and only graphic novel that teaches financial literacy. Through this unique and engaging medium, I'…

$27.99 | The Awesome StuffThe Golden Quest is the first and only graphic novel that teaches financial literacy. Through this unique and engaging medium, I'… -

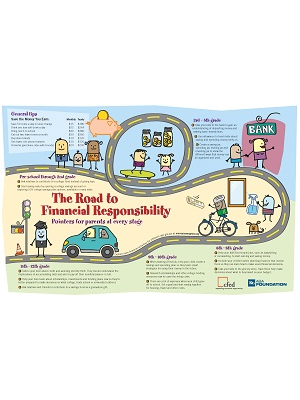

The Road to Financial Responsibility is an infographic that provides tips for adults to discuss money habits with students from p…

The Road to Financial Responsibility is an infographic that provides tips for adults to discuss money habits with students from p… -

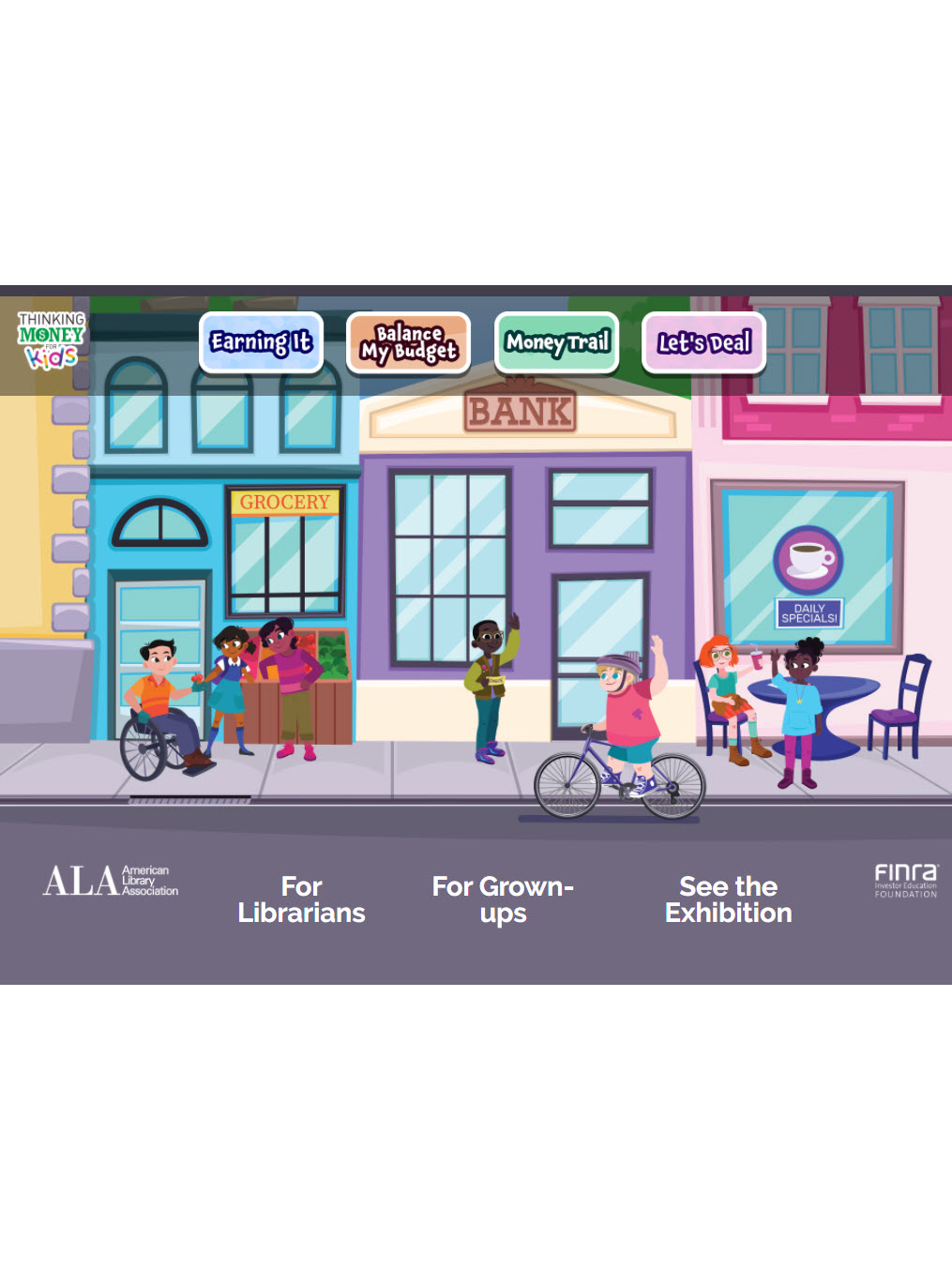

Thinking Money for Kids is a series of interactives to help young people get started on the path to financial literacy. The inter…

Thinking Money for Kids is a series of interactives to help young people get started on the path to financial literacy. The inter… -

FREE | It's a Habit! Company, Inc.SAVE is a free music video located online at YouTube that invites children to start saving and setting goals. The video shares se…