-

Single-Topic Curricula

10 Common Tax Myths, Debunked identifies common tax and policy misconceptions. It is designed to help students learn how to sepa…

10 Common Tax Myths, Debunked identifies common tax and policy misconceptions. It is designed to help students learn how to sepa… -

Single-Topic Curricula

Case Study: Average vs. Marginal Tax Rates explores the difference between tax rates and how each impacts taxpayers' liability a…

Case Study: Average vs. Marginal Tax Rates explores the difference between tax rates and how each impacts taxpayers' liability a… -

Single-Topic Curricula

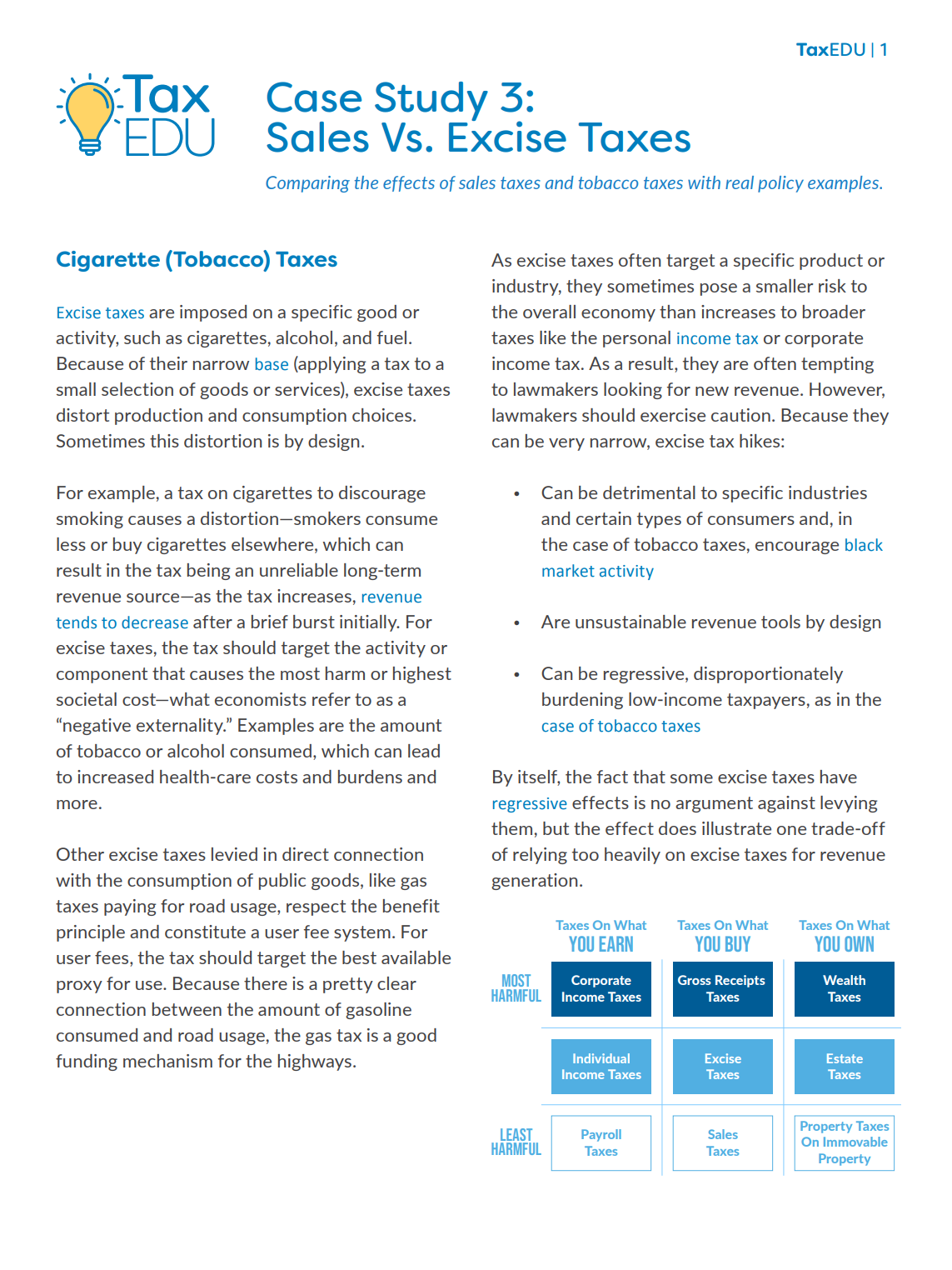

Case Study: Sales Taxes vs. Excise Taxes compares the effects of sales taxes and tobacco taxes with real policy examples.

Case Study: Sales Taxes vs. Excise Taxes compares the effects of sales taxes and tobacco taxes with real policy examples. -

Single-Topic Curricula

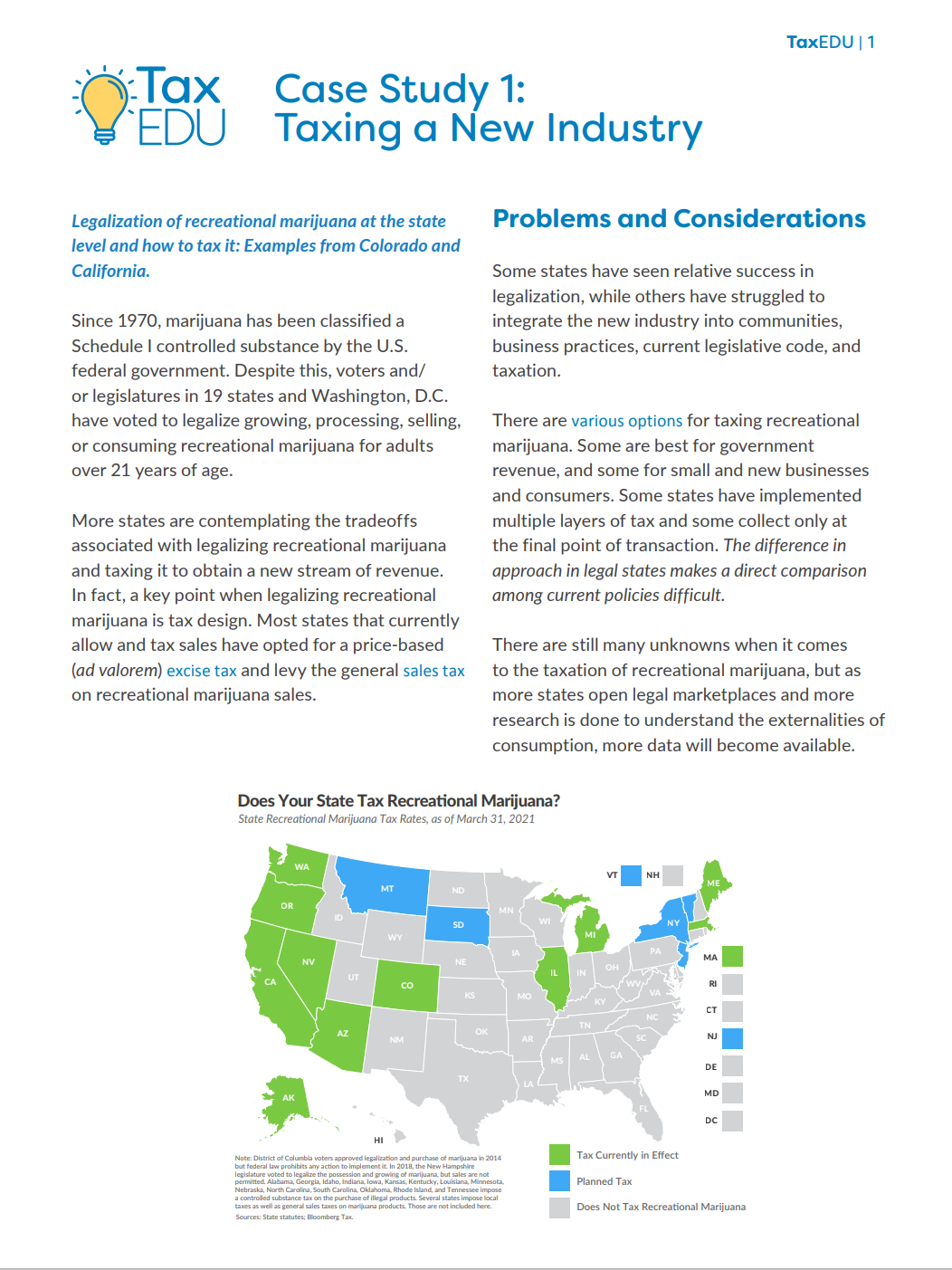

Case Study: Taxing a New Industry examines the legalization of recreational marijuana at the state level and how to tax it, with …

Case Study: Taxing a New Industry examines the legalization of recreational marijuana at the state level and how to tax it, with … -

Single-Topic Curricula

Common Tax Questions, Answered is a primer on tax policy including the basics of who pays taxes, the difference between credits a…

Common Tax Questions, Answered is a primer on tax policy including the basics of who pays taxes, the difference between credits a… -

Single-Topic Curricula

Green Rush: Principles for Taxing Cannabis is a video about how states generate tax revenue from recreational cannabis. Three pr…

Green Rush: Principles for Taxing Cannabis is a video about how states generate tax revenue from recreational cannabis. Three pr… -

Single-Topic Curricula

History of Taxes is a primer about the origination of taxes and how they resemble taxes we have today. It discusses how the Amer…

History of Taxes is a primer about the origination of taxes and how they resemble taxes we have today. It discusses how the Amer… -

Single-Topic Curricula

Not All Taxes Are Created Equal is a lesson plan and assessment designed to help students compare the economic impact of taxes on…

Not All Taxes Are Created Equal is a lesson plan and assessment designed to help students compare the economic impact of taxes on… -

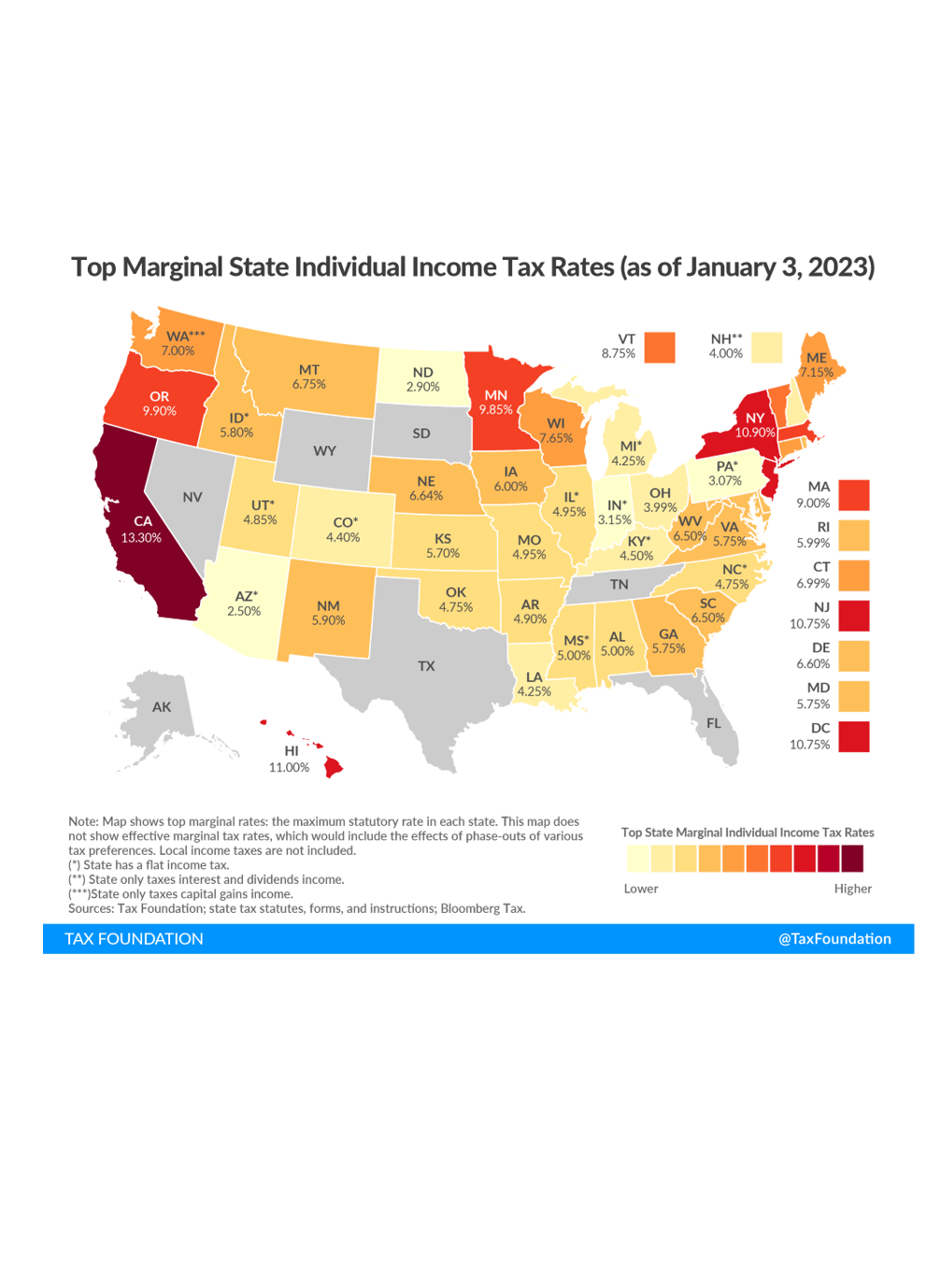

Relate your tax lesson to the real world with Tax Foundation State Tax Maps. These maps show state tax rates for taxes like indiv…

Relate your tax lesson to the real world with Tax Foundation State Tax Maps. These maps show state tax rates for taxes like indiv… -

Single-Topic Curricula

Taxes: The Price We Pay for Government is a primer about the types of taxes governments rely on to fund priorities like infrastru…

Taxes: The Price We Pay for Government is a primer about the types of taxes governments rely on to fund priorities like infrastru… -

Single-Topic Curricula

The Weird Way Taxes Impact Behavior is a primer on how tax policies can influence behavior through the power of incentives. Stud…

The Weird Way Taxes Impact Behavior is a primer on how tax policies can influence behavior through the power of incentives. Stud… -

Single-Topic Curricula

Three Basic Tax Types includes a video, primer, lesson plan, and assessment designed to teach students about taxes on what you ea…

Three Basic Tax Types includes a video, primer, lesson plan, and assessment designed to teach students about taxes on what you ea… -

Videos/Audio

A Carbon Tax, Explained is a 2 minute animated video about how every policy has trade-offs, but a well-designed carbon tax has th…

A Carbon Tax, Explained is a 2 minute animated video about how every policy has trade-offs, but a well-designed carbon tax has th… -

This short, animated explainer video tackles one of the biggest misconceptions about taxes in the U.S.: how the federal income ta…

This short, animated explainer video tackles one of the biggest misconceptions about taxes in the U.S.: how the federal income ta… -

Videos/Audio

The Tariffs Are Taxes Too is a 1.34 minute video that explains how, even though tariffs are invisible, their effects are not. The…

The Tariffs Are Taxes Too is a 1.34 minute video that explains how, even though tariffs are invisible, their effects are not. The… -

The Three Basic Tax Types is a brief animated video that explores how the better you understand taxes, the better equipped you ar…

The Three Basic Tax Types is a brief animated video that explores how the better you understand taxes, the better equipped you ar…